Pearl Hawaii Wealth Advisors

Financial Advisors | Retirement Planning | Investments | Insurance Services

Invest where you belong

With Pearl Hawaii Wealth Advisors, you are guided by a financial advisor with many years of experience. Get guidance to seek the most out of your assets, big or small. Want to save for a dream home? Plan for retirement? Start a nest egg for your child’s future? The possibilities are endless.

Manage your investments with ease

When you open an account with Pearl Hawaii Wealth Advisors, you have the ability to manage multiple types of investments. Additionally, you can access your account anywhere and anytime. Partner with a financial professional to understand your unique financial situation. To get started down a path to financial freedom, make an appointment.

Chris N. Kaminaka, Financial Advisor

As a LPL Financial Advisor, Chris is qualified to provide credit union members with professional assistance, quality financial products, and dependable service. Chris is a Registered Representative of LPL Financial and also a licensed insurance agent. It’s easy to get started. Please contact me for a no-cost, no-obligation consultation.

Chris’ Background

Check the background of this investment professional on FINRA BrokerCheck.

Contact Chris

Mailing Address

94-449 Ukee St

Waipahu, HI 96797

Get Directions

REALITY CHECK ON YOUR RETIREMENT SAVINGS

Whether you’re 23 or 35, it’s important to know whether you are saving enough for your retirement. There is no time like the present to ensure you are allocating enough funds to your retirement account.

With folks routinely living into their 80s and 90s, it’s more important than ever to ensure your money lasts your lifetime. Millennials have the advantage of time. You can benefit from compounding and the long-term trends that can make a real difference over the course of several decades.

A good savings target is 15% of your income. That’s a very general target, and in many cases, it’s too conservative. That can be a real challenge if you are also saving for a house and/or paying off student loans. The important point is to make a commitment to your retirement savings by contributing a consistent amount with each paycheck (or if you are self-employed, every invoice). The absolute percentage is secondary; more important is to set a goal and stick to it.

How will your lifestyle change? In retirement, you may no longer be drawing a salary, although many folks take up some form of self-employment that brings in an income. It’s up to you whether earnings will be part of your retirement plan. If not, your retirement savings should be robust enough to supplement your Social Security without sacrificing your lifestyle. You can check you projected Social Security payments on the Social Security Administration’s website.

Time may heal all wounds. Millennials may have unpleasant memories of the Great Recession and the family turmoil it could have caused. A conservative attitude toward risk isn’t surprising given those circumstances, but sticking to overly conservative investments has its own risks, such as not keeping up with inflation. You have time to recover from the inevitable ups and downs of the markets, which means you might want to consider adding some aggressive investments to your retirement account.

Figure out how long your savings will last. To get a reasonably accurate figure, you should derive your annual “burn rate.” That’s the amount of savings you’ll need to live on each year. You then see whether it will last for your estimated life expectancy, which you can check with any number of online calculators. If the answer is no, you’ll have to increase the amount you save now and/or cut back on your retirement plans.

Your retirement finances are not set in stone. You have options at any age. Call or email me to review those and decide on the best course of action. Don’t put it off—the sooner you understand your financial alternatives, the sooner you can take positive action to protect your golden years.

Source/Disclaimer:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

This material was prepared by LPL Financial, LLC.

Financial Advisor Services

- Financial Management

- Personal Financial Assessments

- Financial Planning

- Retirement Planning

- Insurance Planning

- Education Planning

- Investments

- Wealth Management

- Education Funding

- Retirement Income Planning

- Retirement Services

- Life Insurance

- Long-Term Care Insurance

- Disability Insurance

- IRA Rollover

- TSP Transition Assistance

- Mutual Funds

- IRAs

- Annuities

- Stocks & Bonds

- Managed Accounts

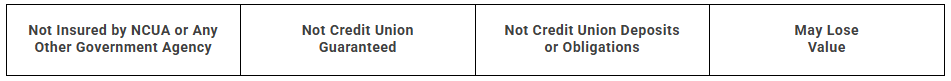

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Pearl Hawaii Federal Credit Union and Pearl Hawaii Wealth Advisors ARE NOT registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Pearl Hawaii Wealth Advisors and may also be employees of Pearl Hawaii Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Pearl Hawaii Federal Credit Union or Pearl Hawaii Wealth Advisors. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL’) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services.

Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

465391-01-02

Test Modal

Modal Content

Ea rerum vel molestiae omnis molestias. Et ut officiis aliquam earum et cum deleniti. Rerum temporibus ex cumque doloribus voluptatem alias.

| Column Title | Column Title | Column Title |

|---|---|---|

| Cell Value | Cell Value | Cell Value |

| Cell Value | Cell Value | Cell Value |

| Cell Value | Cell Value | Cell Value |

| Cell Value | Cell Value | Cell Value |

| Cell Value | Cell Value | Cell Value |

Rates effective as of: February 15, 2026

{Optional: Insert table disclosure information}

Open Account

Leaving Our Website

By accessing this link, you will be leaving the Credit Union’s web site and entering a web site hosted by another party.

Although the Credit Union has approved this as a reliable partner site, please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of the Credit Union’s web site. The other party is solely responsible for the content of its web site.

We encourage you to read and evaluate the privacy and security policies on the site you are entering, which may be different than those of the Credit Union.

You will be leaving the credit union’s site.