AUTOMATED FRAUD ALERTS

Accelerated. Automated.

At Pearl Hawaii Federal Credit Union, we’re serious about protecting you from fraudulent activity on your accounts. That’s why we’ve strengthened our defenses with a new, automated system that can identify threats faster, notify you sooner and equip you with the tools you need to take immediate action against fraud. Previously, you would have only received a personal call from a live agent if fraud was suspected. The new system allows you to receive an automated call that easily walks you through reviewing suspicious activity on your card. You may also receive Automated Fraud Alerts text messages on your mobile phone. We will also send a fraud alert via email and text.

You may receive Automated Fraud Alert messages in the following ways:

- Text/SMS message from 919-37

- Email from FraudAlertsNoReply@phfcu.com

- Call from 888-918-7313

OUR AUTOMATED SYSTEM INCLUDES:

IMMEDIATE FRAUD ALERTS

When a suspicious activity has been detected on your account, we don’t wait for an agent to dial your number – our automated system will contact you by text, phone or email.

2-WAY COMMUNICATION

You can take action the second you receive your alert – by texting the provided command word, or interacting with the automated system on the phone; simply follow the instructions to answer questions regarding your recent card activity.

REAL-TIME SUPPORT

Our live agents are ready to assist you at any time to ensure you receive the best defense exactly when you need it. Don’t delay – Please update your contact information to make sure you receive important fraud alerts about your account.

Members should be aware that, while Pearl Hawaii does monitor fraudulent or suspicious account activity and may proactively contact a member about this activity, we will never call and ask for confidential information such as your entire account number or PIN. Contact 1-808-737-4328 immediately if you have provided confidential information.

FRAUD ALERTS + MONITORING

We are constantly monitoring credit and debit card transactions to identify and prevent fraud on your account. Pearl Hawaii Federal Credit Union is committed to providing our members the best fraud-fighting tools to strengthen our defenses and help our members take immediate action against fraud. When we identify suspicious transactions on your account, we will contact you about the activity via SMS (text), phone, or email to determine if a transaction was authorized.

Please remember that we will never ask for account information, passwords, or other sensitive information via these unsecured channels. Our SMS fraud alerts only require a simple yes (Y) or no (N) reply. If you aren’t certain if the message is authentic, please contact us at 808.737.4328 (73-PHFCU) to learn more. Thank you for being our member and allowing us to secure your account!

PRO TIP

Please make sure to review and update your contact information so that you will receive Automated Fraud Alerts should there be any suspicious transactions on your account.

FRAUD ALERTS | TYPES

- Agent calls

- Emails (Sample In Picture Below)

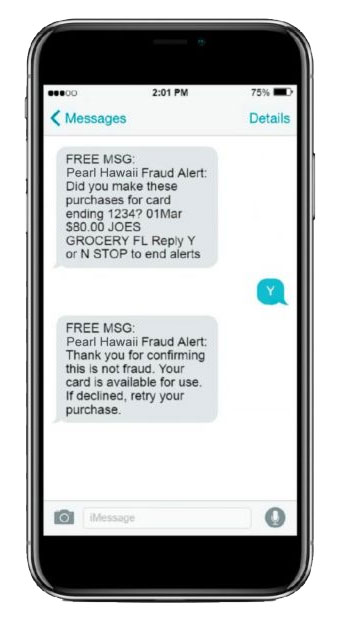

- SMS Text (Sample In Picture Below)

- Digital Voice

FRAUD ALERTS | HOW DOES IT WORK?

- Transactions suspected as fraud are sent to the Fraud Detection Services, which triggers a call to the member from a Fraud Detection Agent.

- An Automated Fraud Alert contacts the member with a Digital Voice (sample automated message below) phone call, SMS Text Message (See below), and an Email Message (see above), providing the suspect activity and allowing the member to confirm the validity or fraudulent nature of the activity.

- Upon confirmation of fraud, the system will disable the affected card and will transfer the member to a live Fraud Detection Services agent to complete the lost or stolen report.

STEPS WE TAKE TO PROTECT YOU

STEP 1 | SMS Text Message

STEP 2| Digital Call #1

When the text message is not answered within 30 minutes, a digital call is made to the mobile phone on file and a message is left when not answered.

STEP 3| Digital Call #2

When there is no response received within 30 minutes of the mobile message, a digital call is made to the home phone and a message is left when not answered.

STEP 4| Digital Call #3

When no response within three hours of the home message, a digital call is made to the home phone again. Another message is not left unless the previous message attempt to the home number was unsuccessful.

STEP 5| Email

When no response to any of the previous contact attempts is received, an email is sent 5 minutes after Digital Call #3 (Step 4). An email will be sent to your Home and Work email address if we have your email on file.

- Emails (see above)

STEP 6| Agent Calls

When we receive no response from the prior steps, a live agent will attempt to contact you.

-

Q: How does it work?

A text message and/or pre-recorded voice call may be sent to your mobile device when there is a suspicious transaction(s) identified. Simply reply to the text to confirm whether or not you recognize the transaction(s). If you do not recognize the transaction(s), you will receive a text asking you to call 888-918-7313 for further assistance. There will be a block placed on your card to protect you from further fraud until you call us. If you reply to the text that you recognize the transaction(s), your card will remain available for use.

If you do not reply to the text within 30 minutes, a pre-recorded voice call may be attempted to your mobile device and a home number listed on your account. If you receive a pre-recorded call, please listen to the prompts provided to review and respond to the validity of each transaction that is presented during the call. An email will also be sent to the address on file to confirm transactions on the account. You can also call us at any time to validate the transactions or if you have any concerns about the message you received.

Q: What is an SMS text?

SMS stands for Short Message Service and is also commonly referred to as a “text message.” With an SMS, you can send a message of up to 160 characters to another device. Longer messages will automatically be split up into several parts. Most mobile phones support this type of text messaging.

Q: How do I register?

There’s no need to register for automated fraud alerts. As a member of Pearl Hawaii you are automatically eligible to receive fraud alerts via SMS, phone, or email. Please make sure to review and update your contact information so that you will receive alerts should there be any suspicious transactions on your account.

Q: How much does it cost to use this service?

There’s no cost to use the automated fraud alerts service. Pearl Hawaii pays for all costs associated with sending and delivering SMS fraud alert messages to your mobile device. This service is provided to you free of charge.

Q: Is this service safe and secure?

Yes! Your security is our first priority. Our fraud alert messages will simply ask you to reply Y or N to confirm charges. We will never ask for your account number, card number, PIN number, or any other personal information via text message. If you ever receive a text message asking for any personal or identifying information, please do not respond. Call Pearl Hawaii at 808.737.4328 (73-PHFCU) immediately to report the fraudulent text message.

Q: What if I do not have text messaging?

You will still receive automated fraud alerts via phone and email. A text messaging plan is not required but is a great way to receive fraud alerts about your Pearl Hawaii account.

Q: What number will the fraud alert come from?

SMS fraud alerts will come from 919-37. You may want to save this number in your contacts with a name you will recognize for future alerts. We recommend ‘Pearl Hawaii Fraud Alerts’. Fraud alert messages sent from this number will also be labeled with the Pearl Hawaii.

Q: If my mobile number changes, what do I do?

Please update your contact information as soon as possible so that alerts will be sent to the proper number on file. You will still receive alerts on your home phone number or email if that information is on file. Accurate contact information is important so that we can reach you in the event we identify suspicious transactions on your account.

Q: Why do I receive multiple messages with Pg 1/2, Pg 2/2?

Most SMS messages have a maximum length of 160 characters per message. Some alerts may require multiple messages to provide you with all the necessary information. All SMS messages are paid by Pearl Hawaii and you will not be charged for any text message alerts.

Q: How do I opt out of text alerts?

To opt out of text alerts, simply reply STOP to any text alert. You will no longer receive fraud alerts via SMS messages. You may also opt out by calling the number provided on the back of your card and asking to be opted out of Automated Fraud Alerts messages.

Q: What happens if the transaction in question in the fraud alert is legitimate?

If you recognize all of the transactions present in the fraud alert. Simply reply “Y”, to confirm the activity as valid. Your card will automatically be unblocked and no further action is required. You may now complete any purchases that may have been declined.

Q: Are the text commands case-sensitive?

No. Commands can be sent as upper-case, lower-case, or a mixture of both.